Smart Budgeting for Your First Apartment or Home: A Beginner’s Guide to Financial Success

Moving into your first apartment or home is a thrilling milestone, but it also comes with financial responsibilities. Without a well-thought-out budget, it’s easy to overspend and find yourself struggling to keep up with bills. Smart budgeting ensures financial stability and allows you to enjoy your new space stress-free. Whether you’re renting or buying, understanding how to allocate your money effectively is key.

Determine Your Budget Before You Move

Before you even start searching for a place, evaluate your finances. Your budget should account for all costs associated with renting or buying a home, not just the monthly payment. A common rule of thumb is that rent or mortgage payments should not exceed 30% of your monthly income. However, it’s essential to consider additional expenses like utilities, maintenance, and unexpected costs.

Start by assessing your monthly income after taxes and subtracting necessary expenses such as student loans, car payments, and groceries. This will give you a clear picture of how much you can afford. If your calculations show that your dream apartment or home is out of reach, consider adjusting your expectations or looking for ways to increase your income.

Factor in Upfront Costs

One of the biggest surprises for first-time renters or buyers is the number of upfront expenses. For renters, these may include a security deposit, first and last month’s rent, and application fees. Buyers face even more significant costs such as down payments, closing fees, and home inspection costs.

For example, if you’re renting a $1,500-per-month apartment and need to pay the first month’s rent, last month’s rent, and a security deposit equal to one month’s rent, you’re looking at an initial cost of $4,500 before even moving in. Planning for these expenses in advance can prevent financial strain and make the transition smoother.

Plan for Monthly Expenses Beyond Rent or Mortgage

Once you’ve secured your new place, the monthly costs go beyond just rent or a mortgage payment. Utilities such as electricity, water, and gas can vary depending on location and usage. Many first-time renters overlook costs like internet, renter’s insurance, and trash collection fees.

For homeowners, expenses include property taxes, homeowners insurance, and maintenance costs. A good rule of thumb is to set aside at least 1% of your home’s value each year for maintenance. For instance, if your home costs $250,000, budgeting $2,500 annually for repairs and upkeep can help you avoid financial surprises.

Furnishing on a Budget

A new home often means the need for furniture and household essentials. It’s tempting to splurge on brand-new decor, but this can quickly drain your savings. Instead, prioritize the necessities first. Look for second-hand options, discount stores, or online marketplaces where people sell gently used furniture.

Consider spreading out purchases over time instead of buying everything at once. Focus on must-have items like a bed, couch, and dining table before adding decorative elements. Thrift stores and budget-friendly retailers can help you create a stylish space without overspending.

Build an Emergency Fund

Unexpected expenses are inevitable, whether it’s a broken appliance, medical emergency, or sudden job loss. Having an emergency fund can provide a financial safety net and prevent reliance on credit cards or loans in times of crisis.

Aim to save at least three to six months’ worth of living expenses. Even if you start small, setting aside a portion of your income each month can build up over time. Consider automating savings to make the process easier and ensure consistency.

Cut Unnecessary Expenses and Stick to a Budget

Living on your own for the first time may reveal spending habits that could be adjusted. Subscription services, dining out, and impulse shopping can add up quickly. Tracking your spending through a budgeting app or spreadsheet can help identify areas where you can cut back.

For example, if you spend $100 a month on coffee, switching to homemade alternatives could save you over $1,000 annually. Small changes in spending habits can make a significant difference in long-term financial stability.

Consider Roommates or Side Income

If your budget is tight, consider having a roommate to split costs. Sharing rent, utilities, and household expenses can significantly reduce your financial burden. Additionally, exploring side gigs like freelancing, tutoring, or part-time jobs can provide extra income to cover expenses.

Many people also monetize their skills or hobbies, such as selling handmade products online, driving for rideshare services, or pet-sitting. These small income streams can add up and make managing expenses more comfortable.

Think Long-Term and Set Financial Goals

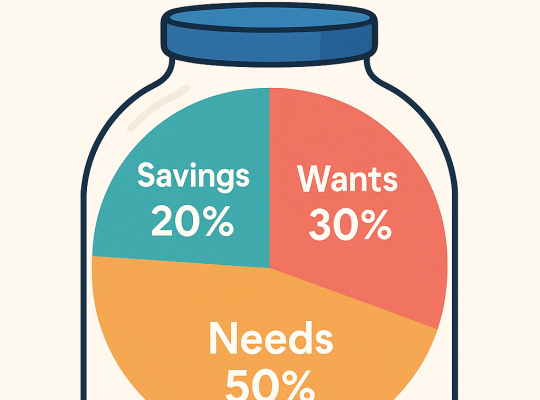

Beyond covering immediate expenses, consider your long-term financial goals. Do you want to save for a future home, pay off debt, or build wealth? Having clear objectives can guide your spending decisions and motivate you to stay disciplined with your budget.

For renters, setting aside money for a future down payment can put you in a better position to buy a home later. Homeowners might focus on paying off their mortgage faster or investing in home improvements that increase property value. Thinking ahead ensures that your financial choices today contribute to future stability.

Final Thoughts

Budgeting for your first apartment or home doesn’t have to be overwhelming. By understanding all expenses involved, prioritizing savings, and making smart financial choices, you can enjoy your new space without financial stress. Whether renting or buying, being proactive with your budget allows you to focus on creating a comfortable and financially secure home. Smart financial habits now will set the foundation for future success.

To know more about financial advice – click here.