Smart Budgeting: How to Set Financial Goals and Achieve Them with Ease

Achieving financial stability isn’t about luck—it’s about strategy. Setting clear financial goals and using a smart budgeting approach can help you take control of your money, reduce stress, and build the future you desire. Whether you’re saving for a big purchase, planning for retirement, or just trying to make ends meet, understanding how to budget effectively is a crucial step toward financial success.

Understanding Your Financial Goals

Before you can start budgeting, you need a clear picture of what you’re working toward. Financial goals can be short-term, such as saving for a vacation, or long-term, like buying a home or retiring comfortably. The key is to set goals that are specific, measurable, and realistic.

For example, instead of saying, “I want to save money,” define your goal as, “I will save $5,000 for a down payment on a car within the next 12 months.” This level of detail gives you a concrete target and a timeline to track your progress.

Creating a Realistic Budget

Once your financial goals are set, the next step is to build a budget that aligns with them. A budget is not a restriction—it’s a plan that empowers you to allocate your income wisely while still enjoying life.

Start by listing all sources of income, including your salary, side hustles, or passive earnings. Then, track your expenses. Break them into fixed costs (rent, utilities, insurance) and variable costs (groceries, entertainment, shopping). This will help you identify where your money is going and where you can make adjustments.

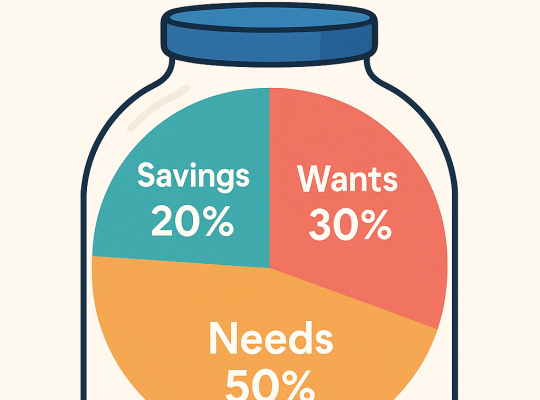

A well-balanced budget follows the 50/30/20 rule:

- 50% of income goes to needs (housing, food, bills)

- 30% is allocated for wants (entertainment, dining out, travel)

- 20% is set aside for savings and debt repayment

This structure ensures you are meeting essential expenses while still setting money aside for future financial health.

Cutting Unnecessary Expenses

Most people don’t realize how much they spend on non-essential items. A daily coffee run, impulse online shopping, or unused subscriptions can quickly add up.

A good way to identify areas for saving is to analyze your past spending habits. If you notice you’re spending $200 a month on takeout, consider cooking at home more often and redirecting those savings into your emergency fund or investment account.

Another effective strategy is the 24-hour rule—before making a non-essential purchase, wait a full day to determine if it’s something you truly need. Often, you’ll find the urge to buy disappears, helping you avoid unnecessary spending.

The Importance of an Emergency Fund

Financial setbacks happen—unexpected medical bills, job loss, or car repairs can throw your budget off track if you’re not prepared. That’s why having an emergency fund is crucial.

Experts recommend saving at least three to six months’ worth of expenses in a separate, easily accessible account. If that seems overwhelming, start small. Even setting aside $50 a month can build a safety net over time and prevent financial stress when emergencies arise.

Automating Your Savings for Success

One of the easiest ways to stay on track with your financial goals is to automate your savings. Setting up an automatic transfer from your paycheck or checking account to a savings or investment account ensures you’re consistently building your financial future without the temptation to spend first.

If your employer offers direct deposit, consider splitting your paycheck so that a percentage goes directly into savings. This “set it and forget it” method helps you save effortlessly and eliminates the risk of forgetting to transfer money manually.

Tracking Your Progress and Adjusting as Needed

A budget isn’t a one-time task—it requires ongoing adjustments based on changes in income, expenses, or financial goals. Checking in on your progress weekly or monthly can help you stay on track and make necessary tweaks.

For instance, if you receive a raise, instead of increasing your spending, consider increasing your savings contributions. Similarly, if an unexpected expense arises, reassess your budget to find areas where you can cut back temporarily.

Using Budgeting Apps to Stay Organized

Technology has made budgeting easier than ever. Apps like Mint, YNAB (You Need a Budget), and EveryDollar can track your income, expenses, and savings goals in real-time. These tools provide insights into spending habits and help ensure you’re sticking to your financial plan.

If you prefer a more traditional approach, using a spreadsheet or a simple notebook to track your finances can be just as effective. The key is consistency—whichever method you choose, stick with it.

Final Thoughts

Smart budgeting isn’t about depriving yourself—it’s about making intentional financial choices that align with your goals. By setting clear objectives, creating a realistic spending plan, and making small, consistent changes, you can achieve financial stability and peace of mind.

No matter where you are in your financial journey, taking control of your budget today will set you up for a more secure and fulfilling future. Start small, stay consistent, and watch your financial goals become reality.

To know more about financial advice – click here.