The Ultimate Guide to Budgeting Apps:

Track Your Spending & Save More Effortlessly

Managing personal finances can feel overwhelming, but technology has made it easier than ever to take control of your money. Budgeting apps have transformed the way people track expenses, save for the future, and build financial security. Whether you’re trying to cut back on unnecessary spending or aiming for long-term financial freedom, the right budgeting app can make all the difference. But how exactly do these apps help, and which features should you focus on to maximize their benefits? Let’s dive into how you can use budgeting apps to track your spending and save more effortlessly.

Why Budgeting Apps Are a Game-Changer for Your Finances

Gone are the days of manually jotting down expenses in a notebook or struggling with complicated spreadsheets. Budgeting apps automate this process, offering real-time insights into where your money is going. They categorize your expenses, highlight areas where you can cut back, and even suggest ways to save more. According to a survey by The Ascent, 74% of people who use budgeting apps feel more in control of their finances compared to those who don’t. The key lies in using these apps effectively.

How to Use Budgeting Apps to Their Full Potential

1. Choose the Right App for Your Needs

Not all budgeting apps are created equal. Some focus on expense tracking, while others specialize in savings goals or investment management. If you’re a beginner, opt for user-friendly apps like Mint or YNAB (You Need A Budget), which offer guided setups and easy-to-understand features. If you’re a small business owner or freelancer, an app like QuickBooks Self-Employed can help you manage both personal and business expenses seamlessly.

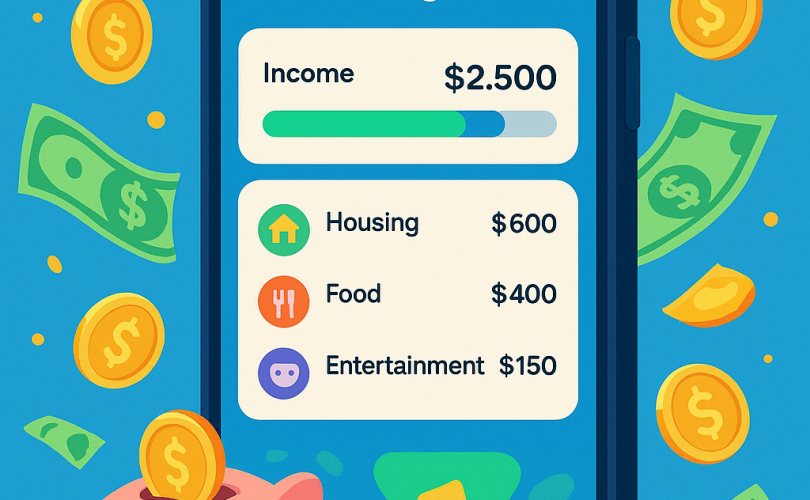

2. Connect Your Bank Accounts for Automated Tracking

One of the biggest advantages of budgeting apps is their ability to sync with your bank accounts. By linking your accounts, transactions are automatically categorized, saving you time and effort. This feature provides a clear picture of your income and expenses without the need for manual data entry. For instance, if you frequently dine out, your app can show you exactly how much you’re spending on restaurants each month, helping you adjust accordingly.

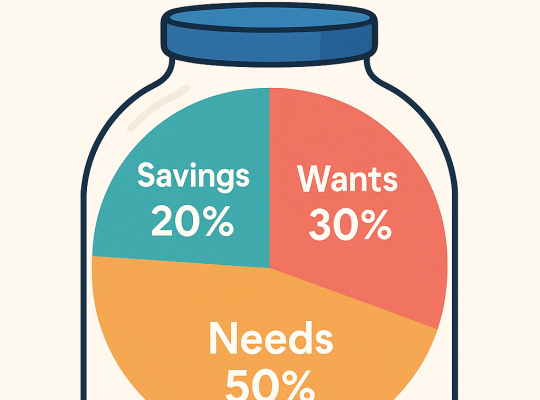

3. Set Realistic Budgets and Stick to Them

Budgeting apps allow you to set spending limits based on your income and financial goals. Whether it’s limiting your monthly dining expenses or reducing impulse shopping, these apps provide alerts when you’re approaching your set limit. A study by NerdWallet found that individuals who set clear spending limits through budgeting apps were 35% more likely to stick to their budgets than those who didn’t.

4. Track Subscriptions and Unnecessary Expenses

Many people underestimate how much they spend on subscriptions. From streaming services to gym memberships, small recurring payments add up quickly. Budgeting apps can track these expenses and even notify you of upcoming charges. If you find that you’re paying for services you no longer use, canceling them can free up extra cash for savings or debt repayment.

5. Use Savings Features to Automate Financial Goals

Budgeting apps don’t just track spending; they also help you save smarter. Many apps, such as Digit or Qapital, use automated savings tools that set aside small amounts of money based on your spending habits. This is an effortless way to build an emergency fund or save for specific goals, such as a vacation or a new gadget, without feeling the pinch.

6. Analyze Spending Trends and Adjust Habits

One of the most powerful features of budgeting apps is their ability to provide spending insights. Over time, these apps generate reports that show where most of your money is going. This allows you to identify patterns and make informed financial decisions. For example, if you notice that dining out consumes a large portion of your budget, you might decide to cook more at home to save money.

7. Take Advantage of Bill Reminders and Payment Scheduling

Late payment fees and missed due dates can hurt your financial health. Budgeting apps offer bill reminders and payment scheduling to help you stay on top of your obligations. By ensuring timely payments, you can avoid unnecessary fees and improve your credit score over time.

8. Stay Motivated with Financial Milestones

Saving money can sometimes feel like a slow process, but budgeting apps can keep you motivated by showing your progress. Many apps offer goal-setting features that track your savings and celebrate milestones. Seeing how far you’ve come can encourage you to stay on track and push towards your financial objectives.

Real-Life Example: How Budgeting Apps Can Transform Your Finances

Take Sarah, for example, a 28-year-old marketing professional who struggled with tracking her expenses. She frequently found herself overspending on dining out and online shopping. After downloading a budgeting app and linking her bank accounts, she quickly realized that she was spending over $500 a month on non-essential purchases. By setting spending limits and using the app’s automated savings feature, she managed to cut back on unnecessary expenses and save an extra $200 per month. Within a year, she had built an emergency fund and even started investing.

Final Thoughts: Take Control of Your Money Today

Budgeting apps are more than just financial tracking tools—they empower you to take control of your spending and achieve your financial goals. By choosing the right app, setting realistic budgets, and making informed financial decisions, you can save more and spend smarter. With just a few taps on your phone, you can transform your money habits and work towards a secure financial future. Ready to take the first step? Download a budgeting app today and start making your money work for you.

To know more about financial advice – click here.